governance

How can districts best deal with state budget deferrals?

CSBA’s July 17 webinar, “Making sense of the budget: What do deferrals mean for school finance?” examined the 2020–21 state budget’s dependence on deferrals and its effect on how local educational agencies will finance expenditures for this year and beyond. Dennis Meyers, CSBA Assistant Executive Director of Governmental Relations, said these deferrals are more severe than those experienced in the Great Recession. “If you were there for that last round of deferrals, that was done over time,” Meyers said. “This is a precipitous ‘boom’ — a lot of deferrals all at one time, which makes these specifically challenging.”

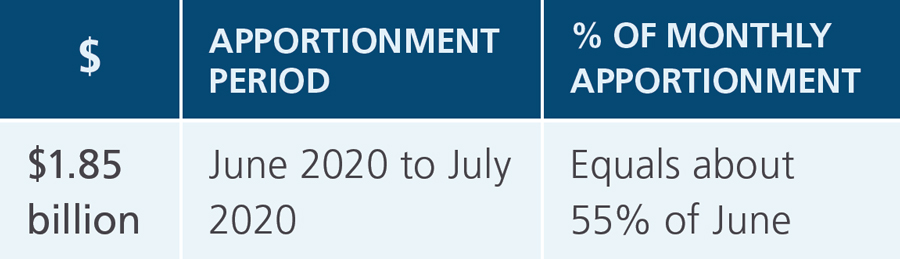

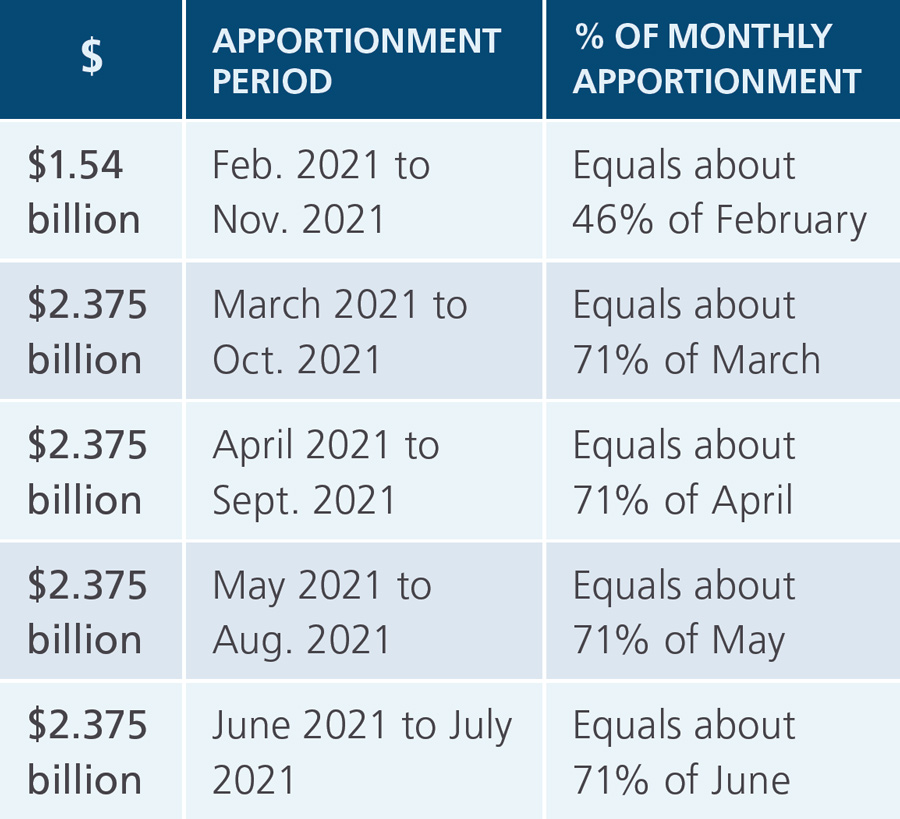

State budget deferral schedule

On average, LEAs will receive about half of their expected revenue from the state, creating a cash management issue when large amounts are deferred. Meyers said there are a few ways to address cash flow issues, including through prudent budgeting and through other reserves that can be borrowed from and paid back. “You have to be really careful to not use one-time reserves for ongoing purposes,” he cautioned. Meyers also said there is an option to get a loan from your county office of education or other county governmental agency, but noted that these entities are most likely also struggling financially.

Current Year (2019–20)

Current Year (2019–20)

Budget Year (2020–21) – $11.06 billion total

Budget Year (2020–21) – $11.06 billion total

Tax Revenue Anticipation Notes (TRANs) offered through CSBA program

Another viable option for managing cash flow issues are Tax Revenue Anticipation Notes, or TRANs, that allow LEAs to borrow money and pay it back once the deferred payments from the state come through. CSBA works with Dale Scott & Company, Piper Sandler and Orrick, Herrington & Sutcliffe to provide members with the California School Cash Reserve Program, which helps guard against temporary cash flow shortages in a safe, cost-effective way by creating an additional cash reserve to the general fund. Participants issue TRANs through a streamlined, pooled process. The pool process offsets the interest costs of the TRAN and potentially some of the issuance costs. Similar LEAs are pooled together so interest rate factors are alike throughout the pool.

Presenter Mark Farrell, senior financial advisor at Dale Scott & Company, said that even just thinking your LEA might run into a cash flow issue is reason enough to consider the Cash Reserve Program. “We want to stress the point of thinking about cash flow early, going ahead and taking a resolution [for the Cash Reserve Program] to the board if you think you might need it, then you can always stop the process, not issue a TRAN, and not incur any cost if your cash situation changes and you don’t need any TRANs,” he said.

Interest rates for TRANs are near historic lows and average around 0.3 percent, though rates vary as they are calculated based on factors such as LEA credit rating, available reserves, cash balances and other funds outside of the general fund.

How to apply for a TRAN

The next regularly scheduled available TRANs pool is for February 2021 and districts should begin the process for applying in August or September; however, there is a possibility for a fall TRAN if an interested LEA missed the July 2019 TRAN pool. “We look at a district’s preliminary cash flow projections to come up with a maximum amount they might need to finance,” said Farrell. “Then we prepare a resolution that districts can take to their boards sometime in that September to December time frame.” As long as the board adopts the resolution by December, the TRAN can be in place by February.

Farrell said that board members should ensure that staff brings a resolution to the board by the end of December so it can approve the resolution in time to have the TRAN in place. “The repayment schedule will be tied to the deferrals, and if we get any federal stimulus and those deferral schedules change, the repayment schedule would match that,” he said.

To learn more about the California School Cash Reserve Program, visit www.csba.org/cashreserveprogram